After moving here, you will need a bank account in Costa Rica. Without it, you’ll be in trouble. How are you going to pay your bills?

I certainly hope you paid attention to my previous blogs and prepared for gaining easy and ongoing access to your funds back home. At the moment, it’s difficult to get financially established in Costa Rica until you have established your legal residency. This will take, at least, six or seven months, possibly more. Meanwhile, you will need a bank account in Costa Rica to pay your bills.

With the new policies in effect as a response to pressure from the U.S. government, in order to open a bank account in Costa Rica at one of the national banks, you must have your residency card, your cedula. Once you have a bank account, your cedula will open doors and will make certain financial functions, like paying bills, a little easier. The process of opening a bank account in Costa Rica at one of the non-national banks is often a little easier. But generally, you must also have your cedula or you must own property in Costa Rica.

But even with your cedula, you will likely be required to provide all or most of the following to open a bank account in Costa Rica.

- A personal referral from a client of the bank where you are applying, your passport

- Proof of income (more on this a bit later)

- Your rental or lease agreement

- A Costa Rican utility bill for the address where you reside,

- and perhaps a few other things.

Be Prepared

There are no hard and fast rules for opening an account at a non-national bank. It really can seem to be a bit arbitrary. We were just able to open a bank account in Costa Rica at a non-national bank without a cedula, without yet owning any Costa Rica real estate and without a utility bill in our name. In our case, there must have been a bit of luck involved and stars were well-aligned. I have to say, however, that we did not go in unprepared.

References

We had read on the internet, that it is difficult to open a bank account in Costa Rica. Although having a Costa Rican bank account and depositing a $1,000 in it a month is a requirement of residency, you must nearly get an invitation from the bank to open that required account. We had also read that it would go a very long way to bring references with you when applying your financial institutions back home. (Request your references on official bank stationary and bearing the signature of the highest-ranking bank official you can get to sign it.) Here’s hoping that you have relatively good credit and a friendly relationship with several banks and financial institutions. We brought six financial references with us to Costa Rica.

Additionally

In addition, what we also had was: an introduction from a client of the bank to which we were applying; a signed agreement to purchase a property; a letter from our Costa Rican attorney verifying the agreement’s authenticity; a copy of our current lease agreement plus a copy of a recent utility bill with the rental property description on it; our official verification of application for residency; our passports, of course; and copies of proof of income.

Proof of income

For proof of income, those who are receiving monthly Social Security income or a national pension payment should have little trouble getting an authentic proof of income certificate from their embassy after they have arrived in Costa Rica. The U.S. Embassy doesn’t make it convenient and requires an appointment. But once you are in the office, it is relatively simple to get. If you have two incomes from your country, go ahead get proof income for both. It should help you during the bank application process. The more family income showed the better as far as the bank is concerned.

For those of you who are not yet receiving a government-sponsored income, it gets a bit “iffier”. We have no concrete first-hand evidence. But have heard from several pre-65-year-old, pre-retirees that other forms of proof of income. Investment income, annuities, North American bank accounts, company pensions, and the like can take months and months to get Costa Rican verification and approval.

Requirements

We may not have met all of the standard requirements for new bank customers, but we overcame any deficiencies by overwhelming them in “official” paperwork. Bureaucracies worldwide seem to be impressed by volumes of official papers. I can’t guarantee that using this approach will help your bank application experience to bear fruit. But it can’t hurt—and, good luck.

The Author

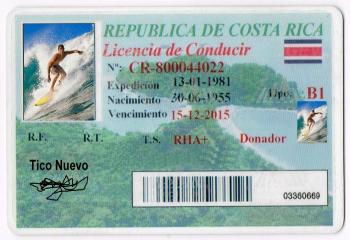

The author of this blog, Ticonuevo, is a US expat who moved to Costa Rica. Ticonuevo used the services of GoDutch Realty to purchase a property in Costa Rica. In his blogs, Ticonuevo describes his own experiences of taking the step of moving to Costa Rica and getting a new life started.