Estimated Reading Time: 7 Minutes

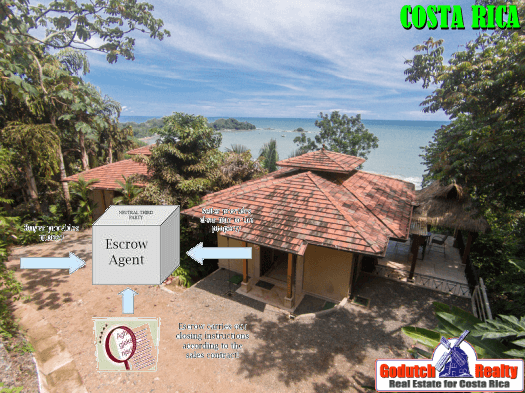

What is Costa Rica escrow, and why should you use escrow for a real estate closing? Is it really necessary? The Costa Rican authorities don’t want you to purchase a property with a wheelbarrow full of money. For many years, cash purchases happened all the time. Worldwide, authorities want more control over what we do and how we do business. So, here is the explanation of what escrow does for everyone involved in real estate transactions.

Costa Rica escrow is a third party that will receive and hold your money until you close your real estate purchase. All escrow companies are registered with Sugef – Superintendencia General de Entidades Financieras – Financial Institution Superintendency.

First, consider whether you use escrow or not; the anti-money laundering and anti-terrorist law 8204 obliges a buyer of property in Costa Rica to prove the origin of the funds.

Law 8204

For a person who does not have a bank account, using escrow is a safe way to get the money for property purchase to Costa Rica, so it’s available on the closing date. The escrow company will request the necessary documentation to comply with law 8204.

Closing is much easier for a person with a bank account in Costa Rica because the funds are readily available. In this case, the real estate company is obliged to comply with law 8204 and request the documentation. Do not forget that as soon as you receive the funds in your bank account (from a property sale, sale of stocks and bonds, inheritance, or other), the bank will also ask you to show where the funds came from.

Earnest Money

BUT where are you going to put the earnest money deposit? Ticos give the earnest money deposit to the seller. But do you want to run the risk of the seller deciding to sell to someone else and spend your earnest money deposit? Then you’ll be in court for years. So yes, why risk losing your money? Use Costa Rica escrow!

A real estate closing in Costa Rica can be smooth if you allow a professional to handle it. But a real estate closing can be full of obstacles, too. If you don’t know what escrow is and that you should use Costa Rica escrow for your real estate closing, you’re not the only one:

The Steps Before Escrow

Here is the step-by-step process so it’s an easier read and simple to follow up on.

- Your real estate agent sent the accepted offer to your attorney to have the option to purchase-sale agreement to be drafted.

- At the signature of this agreement, you will usually have to make an earnest deposit. This can be held in custody by the escrow company or handed over to the seller (not recommended)

- To open escrow, the escrow company will request the buyer the necessary documents to comply with law 8204 (see the list below).

- The escrow company and their bank will open escrow if the documents are correct and complete.

- Now, the earnest money deposit can be wired to Costa Rica escrow

- The escrow company will ask the buyer to send the remaining funds one week before the closing.

Requiered Documentation

Every transaction must be supported at least with the documents mentioned below (this may vary in the future, so ask any Costa Rica escrow company for an update). Any client requiring an escrow account needs to provide the following:

1. Copy of Client’s passport (picture and signature page).

2. Know Your Client form (provided by the Escrow company; no spaces left blank, please sign on page 3). Please let your Account Manager know if you prefer to receive this form via DocuSign.

3. Three months of bank statements where funds wired to the escrow company are held.

4. Latest tax filing or assessment (personal or business, whichever applies).

5. Documents that support the origin of funds to be received by the escrow company. This may be, but not limited to, proof of property sale, salaries, dividends, inheritance, or any other document considered to support.

Salary

If the origin of funds are salaries and/or savings from salaries:

- Public Accountant’s Certification*, Paystubs, or W2 forms confirming salaries

- Employer Reference Letter

- At least three months of account statements where the salaries or savings deposited (with the corresponding trace)

- Proof of withdrawal from IRA account, if applicable

Retirees

If you are currently retired, and the funds originate from savings:

- Proof of IRA withdrawal, if applicable

- Public Accountant Certification* or Pension Administration letter confirming the origin of funds

- Account Statements that support funds held for an extended period as savings (12 or 24-month bank statements).

Dividend Payments

If the origin of funds is dividend payments:

- Corporate proof of ownership (K-1, Certificate of Good Standing*, Articles of Incorporation*)

- Most recent Certified Financial Statements (Balance Sheets and P&L). A Public Accountant* or the owner of the corporation can sign this.

- Proof of dividend payments

- At least three months of account statements where funds are

Real Estate Transaction

If the origin of funds is a real estate sale:

- Closing documents* (sale deed and/or closing statement)

- Proof of payment (incoming wire to your bank account)

- At least three months of bank statements where funds are

- If the Seller is a corporation, please provide proof of ownership*

Inheritance/Divorce/Lawsuit

If the origin of funds is inheritance/divorce settlement/lawsuit:

- A legal document that confirms inheritance or beneficiaries*

- Proof of funds

- At least three months of bank statements where funds are

Bank Loan or Credit

If the origin of funds is a bank loan or line of credit:

- Documents that confirm loan amount or available balance from LOC (LOC statement and bank letter confirming available balance)

- Disbursement proof to a bank account, if applicable

- Documents that support your line of business or source of income

From a Business

If the origin of funds is from a business:

- Documents that confirm ownership (K-1, Certificate of Good Standing*, Articles of Incorporation*)

- Business tax filings

- Most recent Certified Financial Statements (Balance Sheets and P&L). A Public Accountant* or business owner can sign these statements

- Three months of bank statements where funds are

Sale of Stocks

If the origin of funds is the sale of stocks:

- Sale Agreement* or sales receipt

- Documents that support your line of business or source of income

- Proof of funds needed for the purchase of the property

- Three months of bank statements where funds are

Certified or Apostilled

Please consider the following for documents marked with (*) above:

- Copies must be notarized as legit copies of the original and then apostilled or consularized for validation

OR

- Copies must be notarized as legit copies of the original and certified locally by an attorney in Costa Rica. The notarization is unnecessary if corporate ownership is verified online through an official website.

Any document other than Spanish or English must be provided in its original language, along with a mirror translation in SPANISH, and duly signed by the translator (no need for the translation to be official). This includes bank statements.

Your own Bank Account

Don’t you have a bank account in Costa Rica yet? You might think that’s easy? Well, it’s not. A bank won’t open one until you have residency.

So, where should you deposit the earnest money? Costa Rican sellers usually want that earnest money to go to them, but you should insist it goes into escrow with your attorney. That’s one of the main reasons you should use Costa Rica escrow for real estate transactions in our country!

Why?

You probably ask yourself what the reason for all this hassle is. The US government pushed the Costa Rican government for years for proof of origin of the funds for anything over $10,000. Money laundering laws are now in place in every International Monetary Fund (IMF) member country. So, if you decide that purchasing a property in Costa Rica is too much of a hassle, you’ll learn that it won’t be any different in another country.

The when

Don’t wait until you run into trouble. First, choose the real estate attorney, and ask your realtor or the lawyer which escrow company to use. Do this before sending the earnest money to take the property off the market.

The how

The solution is straightforward. All funds, the earnest money, and the balance should go through a Costa Rica escrow account registered with SUGEF. You want to create a paper trail supervised by the Costa Rican government (SUGEF).

Therefore, using escrow in a Costa Rica real estate transaction makes it easier for the buyer and the seller to have no trouble with the proceeds.

Contact a GoDutch Realty agent if you are looking for an expert real estate agent who will hold your hand through closing.