In December 2019, the Costa Rica Tax office published a resolution that starting 2021, existing inactive corporations must declare their assets. This must be done between January 1st and March 15th, 2021.

New corporations will have to do this starting 2020 but let your attorney worry about that when he/she constitutes a new corporation for you.

This resolution DGT-R-075-2019 can be seen in Spanish ALCANCE NO 286 A LA GACETA NO 243, for those interested in a full report.

You might not know that since 2017, owners of a corporation in Costa Rica must pay corporation tax. More about this here.

This corporation tax must be paid every year before January 31st. Active corporations pay a bit more than inactive corporations.

Inactive

Inactive corporations domiciled in Costa Rica that do not carry out a lucrative activity from a Costa Rican source must be registered in the Registro Único Tributario (RUT) of the tax office. As part of this registration, the data of the legal representative, the fiscal domicile, as well as the economic activity must be included.

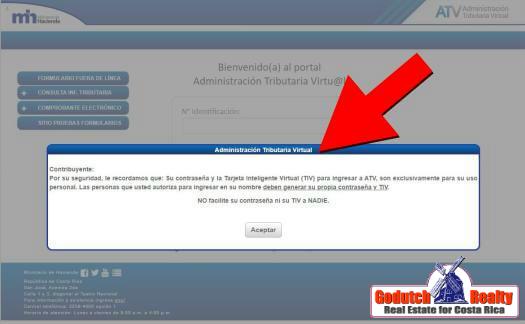

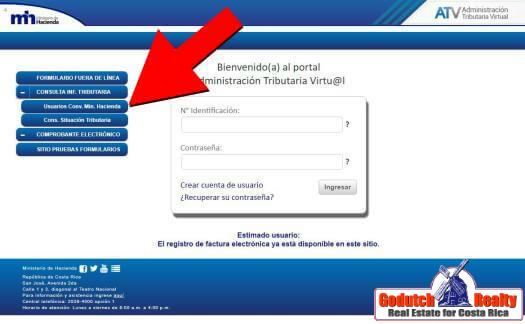

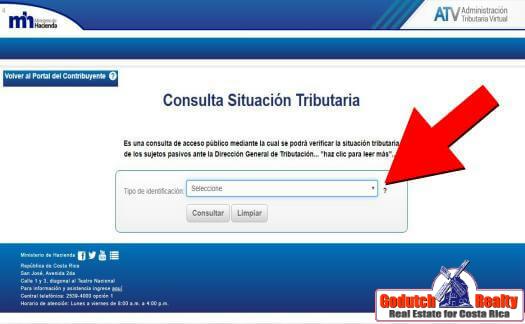

By definition, all corporations are created as inactive. Only if you intend to carry out any business with it, then it will be activated at the Tax Authority (Ministerio de Hacienda) under Income and Sales Tax. You can check everything involving your corporation’s taxes by visiting the virtual tax administration (ATV) on their website. Let me take you through it step by step.

Do NOT pay attention to the white popup with the red arrow. Just click it away.

How to check

Although a little confusing, even if the corporation is inactive, you will see an “A” which means “Active” but it only means that the corporation is affected by the Corporation Tax, Law 9428, not that you have to declare Income or Sales Tax.

Another way to know if your corporation is active or inactive is by checking the amount due for this year, which by the way is around US$119.52, depending on the exchange rate. If you see a higher amount, like ¢112,550, then the corporation is active for the tax authorities. If you think this is a mistake, you need to contact your lawyer or accountant to make the modification.

You don’t need the Identification number or the password. Click where the arrow is on + Consulta Inf. Tributaria – Cons. Situacion Tributaria

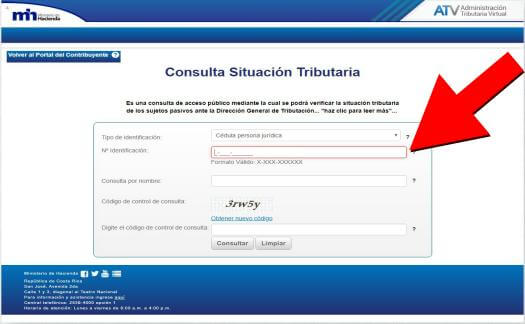

Now select identification type – cédula persona jurídica – and click “consultar”

Now fill out the Identification number of your corporation OR the name and use the CAPTCHA, then click consult

You will now see all the necessary info about your corporation’s tax situation.

Form D.135

Inactive corporations must present the Declaration of Patrimony annually through Form D.135. This form hopefully will be available in the Virtual Tax Administration (ATV) system soon. At the time of publishing this article, the form is not available yet.

The presentation of form D.135 is annually on March 15 at the latest.

The companies must declare their assets, liabilities, and share capital. This information will serve as input for the different control and control processes carried out by the Tax Administration.

These assets can be a property or a car for example.

More info

For more information, please contact your attorney or accountant.

As usual, we appreciate those who read and use our blogs to learn about their legal and tax situation, to request our services when purchasing a property in the Central Valley. Thank you!

This article was revised and corrected by Lic. Francisco Molinero of LandCo.

This article was revised and corrected by Lic. Francisco Molinero of LandCo.

The grammar of the Spanish version of this blog was checked and corrected by Wagner Freer of Spanish School for Residents and Expats. We strongly recommend this language school as your best choice to learn Spanish, click here to contact them.