Estimated Reading Time: 5 Minutes

Did you know you have certain legal obligations when owning a corporation in Costa Rica? Corporations are used to do business and often to hold property. For many years, lawyers have recommended that foreigners use a corporation to own property in Costa Rica for liability reasons. Money laundering laws have created those owning a corporation in Costa Rica other obligations that are difficult to fulfill for non-residents. That is why few property buyers use this tool anymore.

After many discussions, approvals, reforms, and cancellations, the corporation tax—impuesto a las personas jurídicas—was again approved in March 2017. This was the start of new shareholder obligations, which I will explain below.

Unfortunately, many foreigners who own property in Costa Rica don’t know about this obligation to pay the corporation tax annually before January 31st. Often, the shareholders don’t learn about this tax and their other obligations until they decide to sell their property. That’s why I decided to publish this informative blog. So, if you own a corporation with a property or a car, you better read this article.

Corporation Tax

Let’s go through the obligations of the shareholders of corporations first:

Type of Corporations

These are the corporations that must pay the corporation tax or impuesto a las personas jurídicas:

- Sociedad Anónima (S.A.)

- Sociedad de Responsabilidad Limitada (SRL) – Limited Liability Company

- Branches of foreign corporations or their representative

How much tax to Pay

The amounts change every year, so check this before making the payment. These are the corporate tax amounts for 2024:

- Corporations registered without economic activity – ₡69,330.00

- Corporations registered with economic activity with a gross income of less than ₡55,464,000.00 – ₡115,550.00

- Corporations registered with economic activity with a gross income of less than ₡129,416,000.00 – ₡138,660.00

- Corporations registered with economic activity with a gross income over 280 basic salaries – ₡231,100.00

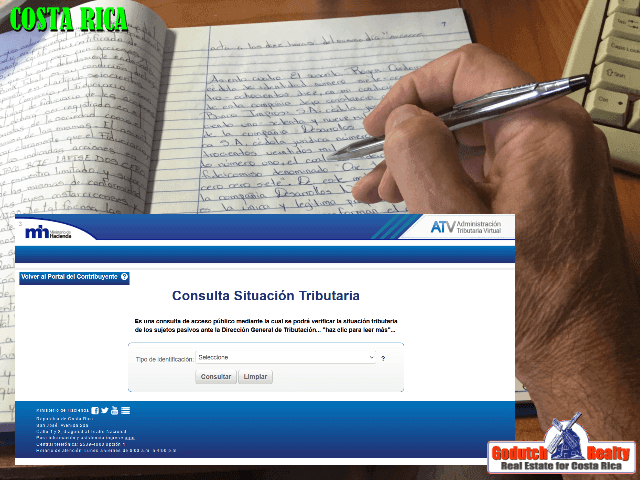

When and Where to Pay

New corporations have to pay when constituted.

Existing corporations must pay the corporation tax every year between January 1st and January 31st to the Finance Ministry – Ministero de Hacienda – at any bank in Costa Rica. If you don’t have a Costa Rican bank account, ask your accountant or attorney to cooperate in making this payment.

Has your corporation had any economic activity? Then, you should also check income tax and other obligations.

When you don’t pay

What will happen if you don’t pay?

- The law allows for the corporations to dissolve automatically when the payment of the tax is three years in arrears,

- If the corporation has any assets at that time, the government will put a legal mortgage – hipoteca legal – on the title of these assets. You need to hire an attorney to clear this lien before you can sell these properties,

- If there is a payment pending, you will not be able to get a certification on that corporation from the National Register,

- You will not be able to do any business with any governmental institution.

Digital Signature

The digital signature law 8454 has been in effect since 2005. The Law of Certificates, Digital Signatures, and Electronic Documents establishes the general legal framework for the transparent, reliable, and secure use of electronic documents and digital signatures in public and private entities. The person legally in charge of a corporation must have a digital signature to comply with the RTBF’s annual registration (see below).

Learn all about the digital signature in Costa Rica in another blog.

RTBF

The Registry of Transparency and Final Beneficiaries (RTBF—Registro de transparencia y beneficiarios Finales) was created under law 9416 to combat tax fraud.

Corporations (their representatives) must declare and update any corporate structure or ownership changes in April of each year. For complete and updated information on RTBF, here is a great article.

Dissolve the corporation

If you have any unused corporations or you’re selling the assets, ask your attorney to dissolve them. If all the shareholders agree, the law allows you to dissolve a corporation. Contact your attorney for information and counsel.

Out of the country?

If you don’t live in Costa Rica and need someone you can trust to keep up with all the legalities regarding your corporation, click on the banner below.

Contact your attorney for more information and counsel. Contact us now if you plan to buy or sell a property in Costa Rica.