I hope you’ve read part 1 of this blog series about the nicest real estate closing of my life. Not every Costa Rica real estate closing is fun.

Who had expected that the bank appraiser obliged to seller to get involved in all kinds of extra payments? Especially because in Costa Rica, you buy a house “as is”.

When you purchase real estate in Costa Rica and you need a bank mortgage, I recommend you follow this blog series. It will save you lots of time, effort, and mostly gall problems.

Check on the requested documents mentioned in part 1, so they can pre-qualify you (or not) before you start shopping for a home.

The paperwork mentioned in part a is mostly the same in every Costa Rican bank, but ask your banker for the list. The nicest real estate closing of my life was done this time through BAC San Jose. Thanks to an outstanding bank executive, very cooperative buyers, and the accommodating seller, this closing had a very happy ending.

Tax Certification

The bank requests a certification from the municipality that the property tax and municipal tax (garbage and streetlights) are up to date. Showing the last paid bill is not enough. The bank wants to make absolutely sure there are no payments pending.

Your realtor should be able to help you with the property tax certification. Some property owners will have paid their Municipal and property taxes for the whole year. The bank only requires the pending quarter to be paid.

Filling out a simple request form and buying some stamps (or at the Bazar across the street) at your Municipality should do to get the payments certified.

The Appraisal

And here comes the most important step of the process, the appraisal. I can’t have the nicest real estate closing of my life without a favorable appraisal. The bank appraiser is paid by you, the buyer. Nonetheless, he/she has the full confidence of the bank.

So be ready to provide the appraiser with all the important details that will add value to the property. Insist your realtor is present at this appraisal/inspection and knows everything there is to know about the property.

It is important to note that the house was at least 45 years old. And the buyer was not interested in a home inspection. But it turned out, the bank appraisal included a simple home inspection.

The cost of the bank appraisal was $900. And there was an additional $100 fee for each time the appraiser should have to return. The return visit will happen in case the appraiser recommends certain repairs and needs to go back to check the repairs. This huge fee was quite unusual for me. Usually, banks charge $500 at the most for an appraisal.

Since the buyer pays for the appraisal, he/she should ask for a copy of it. In case the bank does not accept the first appraisal, you have the right to ask the appraiser to correct any mistakes he might have made. Go over all the details with your realtor if that happens.

Electrical and extermination

I had another surprise! The bank’s executive told me that the bank appraiser, apart from the appraisal, was going to do some kind of a home inspection. He told me to watch out for:

- Roof leaks,

- Loose electrical wires,

- Covered octagonal electrical connection boxes.

Then I knew we had to do with a US type home inspection/appraisal. Costa Rican electricians like to leave the boxes uncovered to fix anything without having to unscrew these boxes while lying on a ceiling. And the covers get lost.

The Inspection

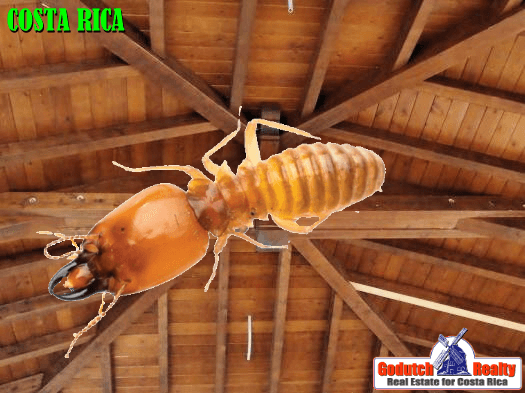

The bank appraiser told me that, because there is so much wood in the house, the seller needed to have extermination done. The exterminator had to certify that less than 95% of the wood is damaged by termites.

Just to get this certification we had to call all exterminators in the phone book. We finally found one who was able to extend the certification. Of course, after the exterminator’s inspection and receiving the certification, the buyer had to pay the additional $100 for the appraiser to come back.

I was happy the seller was willing to cooperate. Additionally to all these payments, the electrician charged $1,100 to fix everything that the bank appraiser came up with. But he understood it was either that or lose the sale because the bank didn’t qualify the property.

If you enjoyed this article, about the closing of my life. You should also read part 1 and part 3 of this series. They are complementary to each other.